Agile Pre-Trade engine with loads of analytics

Comprehensive portfolio risk management with high performance

Covering all asset classes (Interest Rates, FX, Credit, Equities, Commodities, Cryptos)

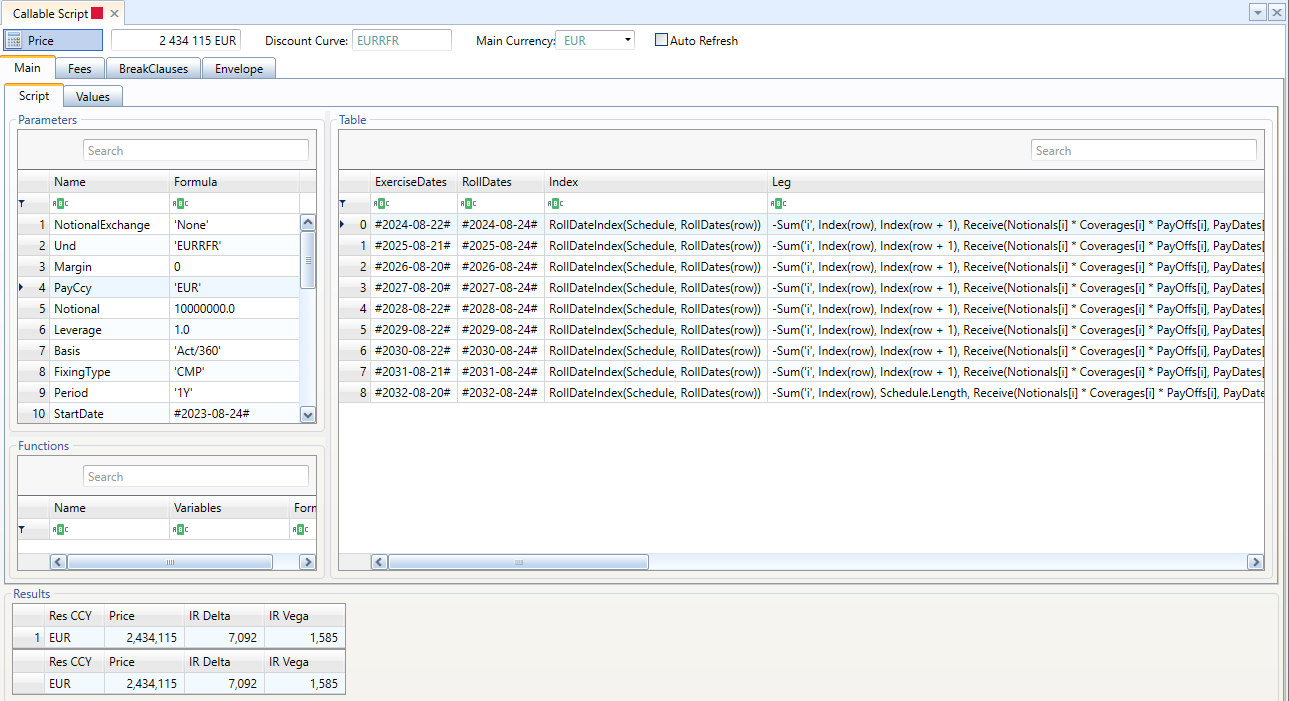

Pricing Engine

Full coverage

All asset classes covered

Coverage includes flows, options and exotics

Payoff script allows to price virtually anything

Universal Model for exotics

In the same Monte-Carlo simulation, one supports:

- As many underlyings as required in any asset class

- Assets in local volatility or local stochastic volatility

- Stochastic (normal) rates with multiple factors

- Stochastic volatility on rates

- Stochastic credit spreads with (J)CIR++ dynamics

- Generic and product specific control variates

State of the art modelling

Pricing models include:

- Multi-curve discounting

- Shifted SABR, AFI, SVI smile interpolations

- Equity to Credit with local volatility for convertible bonds

Performance

Utmost performance thanks notably to multi-threading and auto-differentiation (AD):

- Yield curve stripping is super-fast: up to 400 curves / core / second

- The risks of a portfolio of 10,000 swaps of 10-year average maturity will require 0.5 second to compute

- Full XVA risks are obtained through pathwise AD, so we combine the benefits of a better accuracy (pathwise differentiation) with the spectacular performance of AD

Pre-Trade Analysis

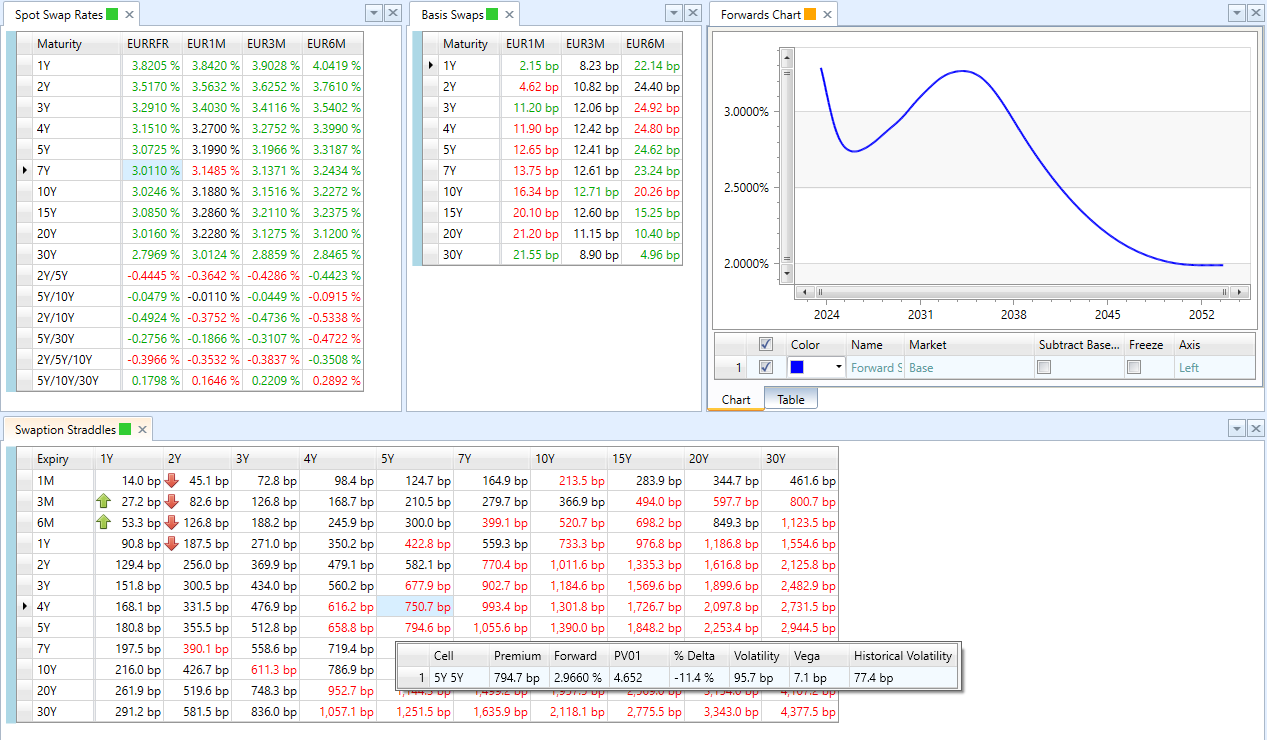

Ensure up-to-date market data

Automatically contribute market data

Real-time status of required market data

Understand your risks

All risk measures, including full sensitivities, are available instantly

Follow the market

50+ configurable screens and charts

Load all relevant views in one click

Instant scenarios

Move any sensitive market data in a few clicks

Get trade ideas

Many relative value indicators are available on whole ranges of instruments

Analyse historical derived market data such as historical volatility or correlation

Fine-tune your structure

Payoff script allows end-user deal customization

Generic solver to solve any deal param on any measure

Customized pricing measures : for instance, define your own bid/offer

Aggregate with your portfolio

Incremental impact of new/amended deal on any measure, including XVA, Capital, Initial Margin

All portfolio measures available in stand-alone mode

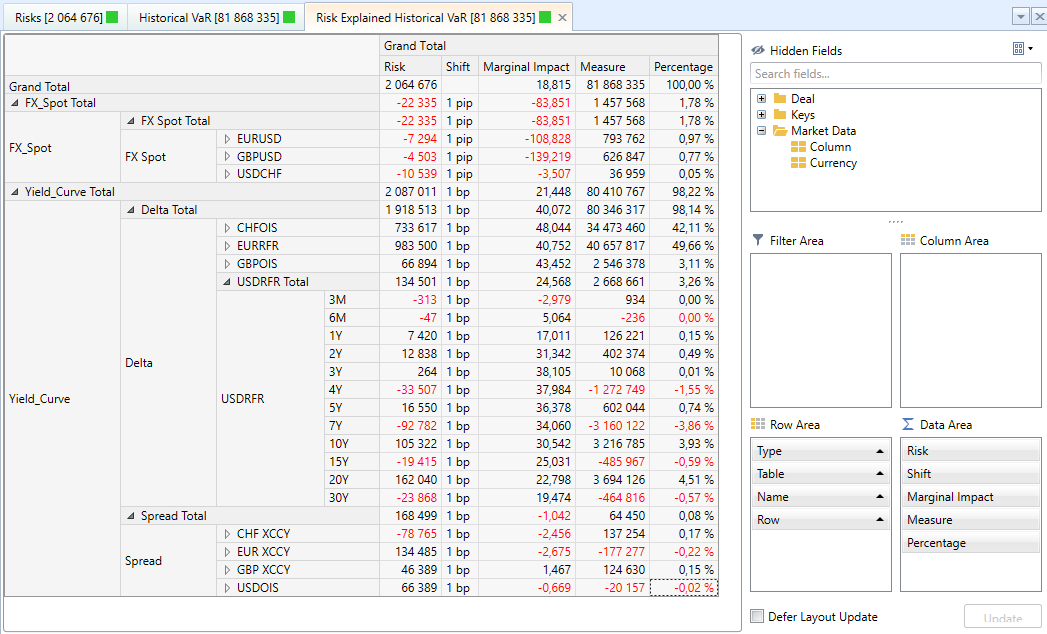

Portfolio Risk Management

Risks & P&L

Full sensitivities (tenor based)

Risk explained P&L, with 2nd order P&L explanation

Realized P&L with curve-by-curve granularity, 2nd order cross effects are also captured

Portfolio replication tool allowing to generate a portfolio from risks

Value-at-Risk

Historical or Monte-Carlo VaR/ES

Capital

Most Basel 2.5 and all FRTB measures are supported

Initial Margin

All measures are supported : SIMM, hVaR, SPAN

Licensed vendor of ISDA SIMMTM

XVA

All XVA measures (CVA, DVA, FVA, MVA, KVA) as well as exposures (EE, NEE, PFE, ...)

Full XVA risks (tenor based)

Exotic features supported such as wrong-way risks, CSAs with thresholds and MTAs

Exposures are computed with the Universal Model

Stress scenarios

Define stress scenarios in a few clicks

Available across all portfolio measures

Evaluate any portolio measure at a future date

Marginal Allocation

Marginal allocation up to deal level available for all global measures (Capital, VaR, IM, XVA) at almost no extra cost

Slice and Dice

All reports displayed in a pivot table allowing breakdown up to deal level

Drill-down on double-click, charts

Integration

Plug and Play

Many trade formats (flat files and XML) are supported

Combined with automatic market data contribution, one can price a whole position within hours, not months

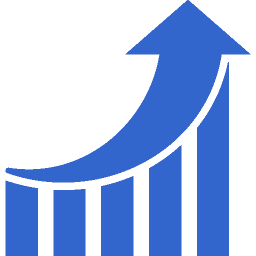

API

One-to-one correspondence between the GUI and the API

Automatic API code generation, in C# or Python (like « record a macro » in Excel)

Agility

Continuous development with straightforward release cycle

Same day bug fix in case of emergency