Product coverage

50+ currencies : EUR, USD, GBP, JPY, CHF, CAD, AUD, NZD, ZAR, Skandies, Eastern Europe, non-deliverable currencies...

Interest Rates:

- Swaps (outright, basis, cross-currency, non deliverable), FRAs

- Bonds: nominal, floaters, inflation-linked and exotics. Repos. Asset swaps. Bond locks.

- Swaptions (vanilla, amortized, forward start), caps & floors, binary options

- CMS, CMS spread swaps and options

- Futures: STIR, bonds, deliverable swap, Eris, STIR and bond future options

- Inflation: bonds, zero-coupon swaps, year-on-year swaps and options

- Generic callable notes: bermudan swaptions, callable range accruals, callable spread options, multi/auto-callable notes

All types of underlyings are supported: OIS/RFR, IBOR, Term RFR, CMS/CMT, CMS Spreads.

Non-standard features include:

- Quanto

- In-arrears, any payment delay

- Amortization, easy handling of all types of schedules

- Averages of underlyings

Credit Derivatives:

- CDS, Recovery swaps

- Corporate Bonds

- Default Swaptions

- Multi-name exotics: single tranches, default baskets

- Credit linked notes, including callable ones

- Structured notes (e.g. callable on CMS spread option with corporate issuer)

- Convertible bonds

All types of underlyings are supported: single-name, index and bespoke portfolios.

Illiquid names are also supported thanks to cross-section projection.

Non-standard features include:

- Quanto

- Fixed Recovery

Assets (FX, Equities, Commodities, Cryptocurrencies):

- Outright (spot, forward, NDF), swaps, futures

- Vanilla options (European/American), NDOs, future options

- Asian Options

- Variance/volatility/gamma swaps, options and corridors

- Forward volatility agreements

- Equity volatility future & options (VIX)

- American single and double barriers, no-touch/single touch

- Lookbacks

- Generic auto-callables

- FX window forwards, commodity swings

- FX correlation swaps

- Convertible bonds

Non-standard features include:

- Quanto

- Composite underlying

- Basket underlying

- Forward start options

- Adjustable exercise window for american barriers

Product customization

Generic Product capabilities :

-

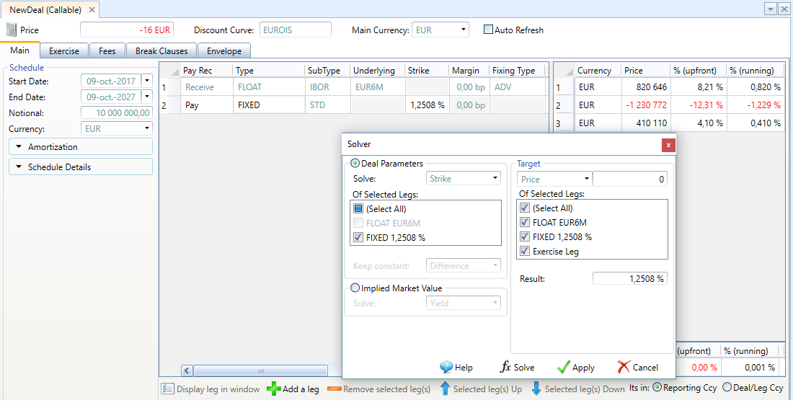

Multi-leg product allows to price as many legs as required.

It's for instance easy to add an option leg on a swap - Callable and auto-callable structures are built on this multi-leg to allow maximum genericity

- Legs can be of different types (hybrid products)

- Payoff script allows to price virtually any structure

- Simplified input masks for recurrent structures

Payoff script

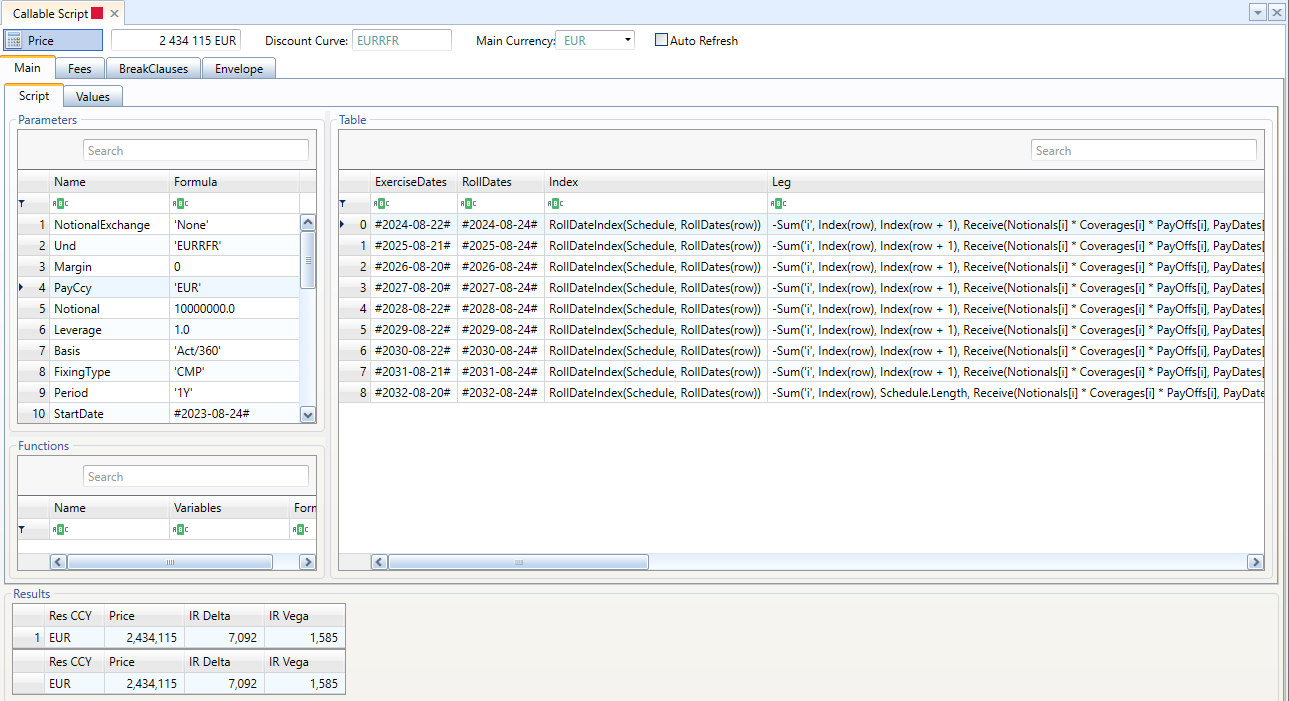

Payoff script allows to price virtually any structure.

Building a script from scratch is usually very difficult. In CRZ Pricer, most deals can be converted into a script and then amended relatively easily.

Furthermore, end-users can create their own simplified input masks and price them internally using script.

The following features are available for an optimal efficiency:

- Caching: A cell will never be evaluated more than once

- Parsing: Formula parsing is done once per cell and not once par Monte-Carlo path as it is frequently the case. This is a consequence of the Monte-Carlo vectorization. It makes parsing very efficient and script based pricing as efficient as a standard exotic pricing.

- Completeness: Most deals can be represented as a script. One can mention the Expectation keyword which allows to price optimal exercise through American Monte-Carlo. One can also mention the Vector keyword which allows to write simpler formulas by grouping, for instance, all flows of a leg (see for instance the script corresponding to an IR swap).

- AutoDiff: Sensitivities are computed through Auto-Differentiation

- Debugging: One can inspect the value of each cell in the Values tab. When the cell output is a Monte-Carlo simulation, both expectation and standard deviation are displayed