We believe that performance is a feature

The user experience improves dramatically if he switches from overnight batches to real-time numbers

Auto-differentiation

This innovative technology makes it possible to calculate derivatives very quickly. More precisely, whereas the naive

method requires N recalculations of functions to calculate N derivatives, auto-differentiation calculates all the derivatives

of a function in a single operation. We apply it to 4 areas :

- Numerical optimization, equation solving : CRZ Pricer can strip up to 2,500 yield curves in one second.

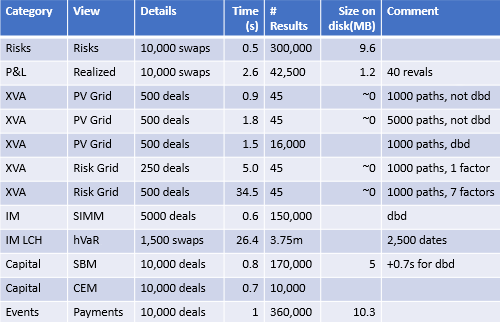

- Risk calculation : the risks of 10,000 swaps are obtained in less than a second

-

XVA risks : this requires calculating the derivatives in all the states of the world !

The calculation remains cumbersome with auto-differentiation, but it is nevertheless performing well (see table below). -

Marginal allocation of a non-linear measure (capital, initial margin, XVA) :

This amounts to calculating the derivatives of the measure to the deal nominals. Because the number of deals can be very large, this very useful functionality is simply not available without auto-differentiation.

Other features

Fully multi-threaded architecture : calculations run in parallel

Monte-Carlo engine is vectorized. It supports optimal exercice (American Monte-Carlo)

Network access minimization : one single call to the database is sufficient to load all the market data required to price a portfolio

Results

Results calculated on an i7-5960X processor (8 cores)