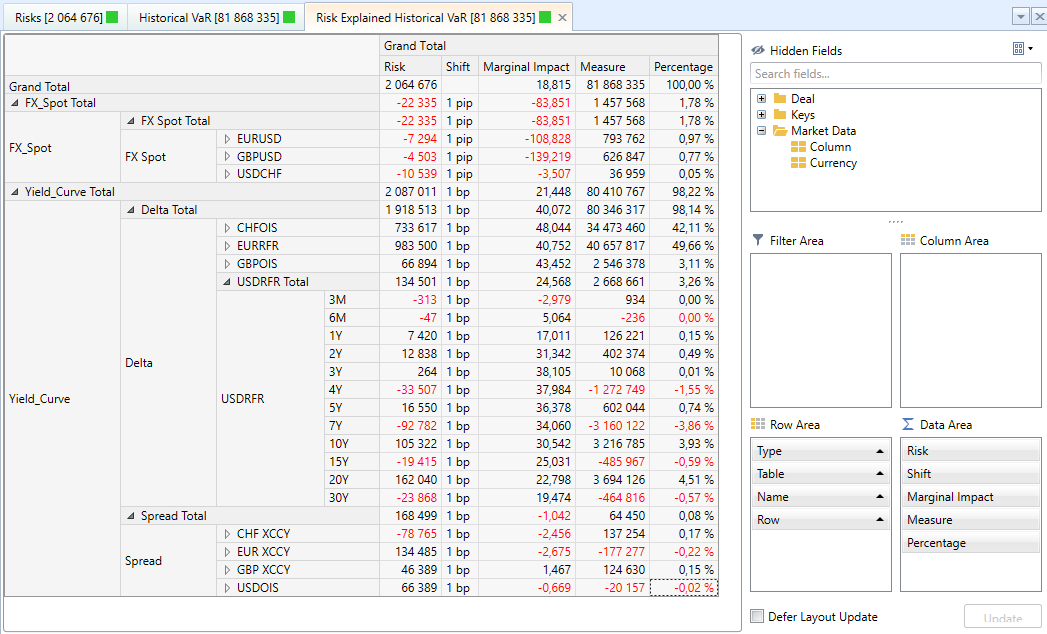

Risks & P&L

Real-time and historical Valuations

Full risks (tenor based)

Risk explained P&L, with second order P&L explanation through re-computation of the risks at end of day

Realized P&L with curve-by-curve granularity (second order cross effects are also captured)

Past and future payment reports, options and fixings expiry reports

Value-at-Risk

This engine is used in various contexts: pure Var/ES calculation but also capital measures (FRTB IMA, CVA IMM), IM calculations (Cleared OTCs with specificities per CCP), SIMM back testing, Beta sensitivities.

- Historical or Monte-Carlo

- Scenario generation from historical market data or shock flat files

- Volatility Scaling

- Many options are available for fine-tuning and to fit CCP methodologies

- P&Ls can be calculated as PV differences or as a first order risk explanation

- Monte-Carlo VaR: Implementation with fat tails (t-Student distribution) available

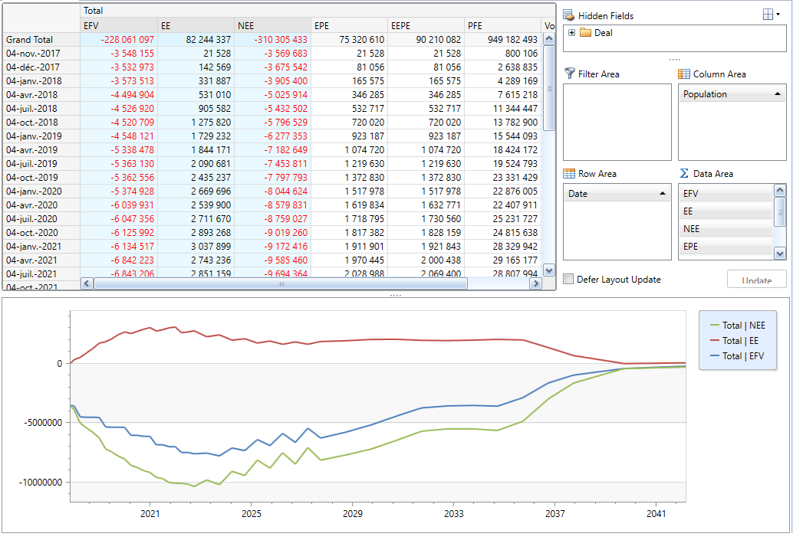

XVA

- All XVA measures (CVA, DVA, FVA, MVA, KVA) as well as exposures (EE, NEE, PFE, ...)

- FVA is fully configurable as there is currently no market consensus

- Full XVA risks (tenor based) are available for efficient dynamic hedging

- Incremental impacts of deals can be calculated without re-computing the whole netting set

- Marginal allocation up to deal level allows you to instantly view the main contributors to any measure

- Wrong-way risk is supported

- Exotic CSA features such as one-way, non zero thresholds, minimum transfer amounts are supported

Capital : Basel 2.5 & FRTB

- Most Basel 2.5 measures (VaR, sVaR, IRC, CEM, SA-CCR, CCR-IMM, CVA-SA, CVA-IMM)

- All FRTB SA measures (SBM, DRC, RRAO, SA-CVA, BA-CVA)

- All FRTB IMA measures (ES, DRC, CVA) where non modellable risk factors are configurable

- P&L attribution

- View aggregated measure and deal-by-deal components (PV, risk weight, ...)

- A capital dashboard allows the aggregation of all the capital measures

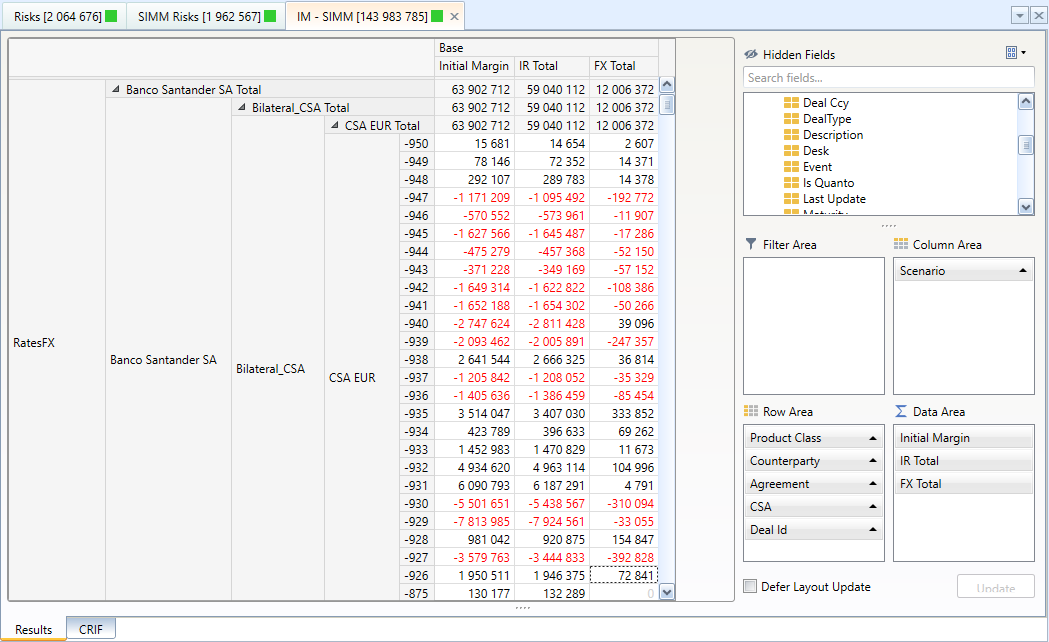

Initial Margin

-

Licensed vendor of ISDA SIMMTM for bilateral initial margin

Versioning is included and underlying risks are converted in CRIF format. CRIF results are displayed together with the aggregated SIMM measure. - Marginal impact of risks allowing initial margin optimisation

- Historical VaR / ES for cleared OTCs

- SPAN for listed products

- CCP basis spreads (such as CME vs LCH) are taken into account

Flexible portfolio views

Results are displayed in customizable pivot tables, allowing for example to break down a result by product, currency or sub-portfolio

Modular stress scenarios: any measure can be computed on a stress scenario