Common

- [New] Added a Relative Historical Shock scenario that applies the difference between two historical markets on the current market

- [New] Reduced significantly the size of the installer (from 83Mo to 50Mo)

- [Bug] Historical contribution from Bloomberg can now be much faster when few market data are contributed at the same time. It used to be single-threaded per market data

- [Bug] Historical recontribution of existing market data could give false negatives (find differences while the market data were actually the same)

FX/EQ/CO

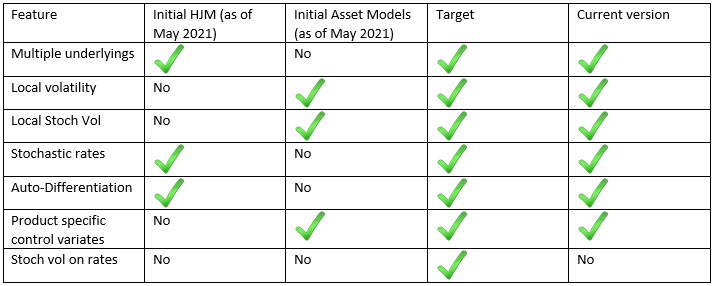

- [New] HJM Model now supports in the same simulation Local volatility and stochastic rates

- [New] HJM Model now supports Local Stochastic Volatility (together with stochastic rates)

- [New] HJM Model now supports affine dividends

- [New] In HJM Model, added the control variates Match Underlying, Lognormal closed formula and importance sampling

- [New] Added scenarios flat continuous dividend and flat convenience yield

IR

- [Bug] Expiries of mid-curve options on short futures could be wrong (were the same as standard options)

Exotic model